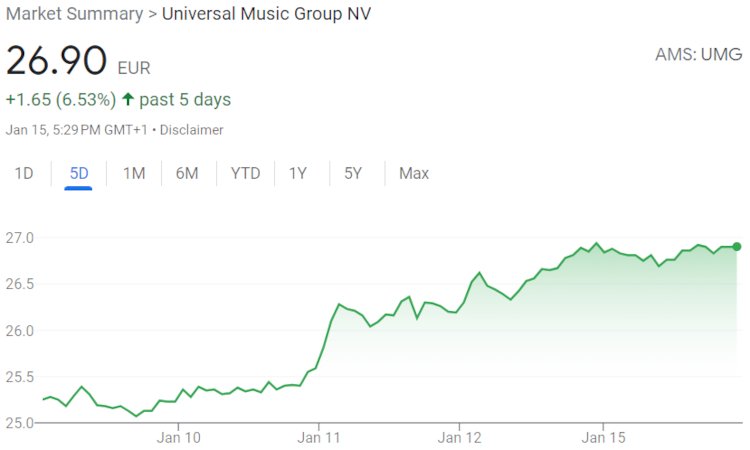

Universal Music Group Stock Spikes Following Layoff Reports — Market Cap Tops $53 Billion

Universal Music Group stock (UMG on the Euronext Amsterdam) has surged following reports of planned Q1 layoffs.

Universal Music Group stock (UMG on the Euronext Amsterdam) has turned in a more than 6.5 percent valuation improvement following news of the major label’s layoff plans.

At the time of this writing, Universal Music Group stock was worth €26.90 ($29.45 at the present euro-dollar exchange rate) per share, reflecting a 6.5 percent increase from its price five trading days back. The per-share value also marks a roughly 15 percent boost from mid-January of 2023 as well as an approximately 27 percent hike from July of the same year.

As mentioned, the current valuation surge appears to have coincided with details about layoffs at the Big Three label. Reports last week indicated that Universal Music, whose CEO is decidedly well compensated, would axe “hundreds” of jobs, focusing particularly on the recorded music division, throughout 2024’s opening quarter.

According to Universal Music’s Q3 2023 earnings report, income in the broader recorded music category slipped slightly year over year (YoY), to approximately $2.2 billion. All told, though, the business’s Q3 revenue is said to have cracked $3 billion (up 3.3 percent YoY) due to growth in areas including physical products and streaming.

The coming weeks will, of course, reveal the precise extent, operational impact, and stock-price significance of the forthcoming layoffs. Universal Music reportedly had 10,000 or so employees as of 2022’s conclusion, and the company is hardly alone in cutting personnel as of late.

To be sure, recent months have seen Discord, Amazon (including Twitch, Amazon Music, Prime Video, and Audible), and Spotify make team-member reductions of their own, following layoffs from Robert Kyncl-led Warner Music Group, BMG, and others.

Publicly disclosed in early December, Spotify’s layoffs, presumably representing one step on a journey towards regular profitability, have extended to a noteworthy 17 percent of its team. Moving forward, CEO Daniel Ek has made clear that he intends to keep the business in the black – but time will tell whether profitability becomes the norm in 2024.

In any event, regulatory filings show that Spotify could incur once-off costs of close to $160 million in connection with the layoffs. And on the market front, it bears highlighting in conclusion that Spotify stock (NYSE: SPOT), at $203 per share, is up more than 120 percent from the same point in 2023.

Nevertheless, the price remains well beneath the astonishing $360 or so that SPOT hit towards the beginning of 2021, amid, among additional things, a wave of investor optimism stemming from the closure of an exclusive deal for The Joe Rogan Experience.

Link to the source article – https://www.digitalmusicnews.com/2024/01/15/universal-music-group-stock-spike-january-2024/

Recommended for you

-

Boss BT-Dual Bluetooth Audio MIDI Dual Adapter

$59,99 Buy From Amazon -

Mini Ukulele Chord Chart Laminated – Ukulele Chords Poster for Beginners and Musicians – Beginner Ukulele Music Theory Trainer – Ukulele Accessories – 8.5″ x 11″ – Walrus Productions

$7,50 Buy From Amazon -

Laminated 4 String Bass Fretboard Notes Chart Nashville Number System & Circle of 5ths Easy Instructional Poster for Beginner for Notebook – A New Song Music 8.5 x 11

$12,99 Buy From Amazon -

Roland JP-8080 – the King of Dance – Large original WAVE/Kontakt Samples/loops Library

$14,99 Buy From Amazon -

Cable Matters 2-Pack 5 Pin DIN MIDI Coupler Gender Changer (MIDI Extender Adapter)

$8,99 Buy From Amazon -

AKAI Professional MPK Mini MK3 – 25 Key USB MIDI Keyboard Controller With 8 Backlit Drum Pads, 8 Knobs and Music Production Software included, Black

$99,00 Buy From Amazon -

Steinberg UR22C 2×2 USB 3.0 Audio Interface with Cubase AI and Cubasis LE

$165,99 Buy From Amazon

Responses