How Many Tracks Will Be Eliminated by Spotify’s 1,000-Play Minimum? Now We Have a Number

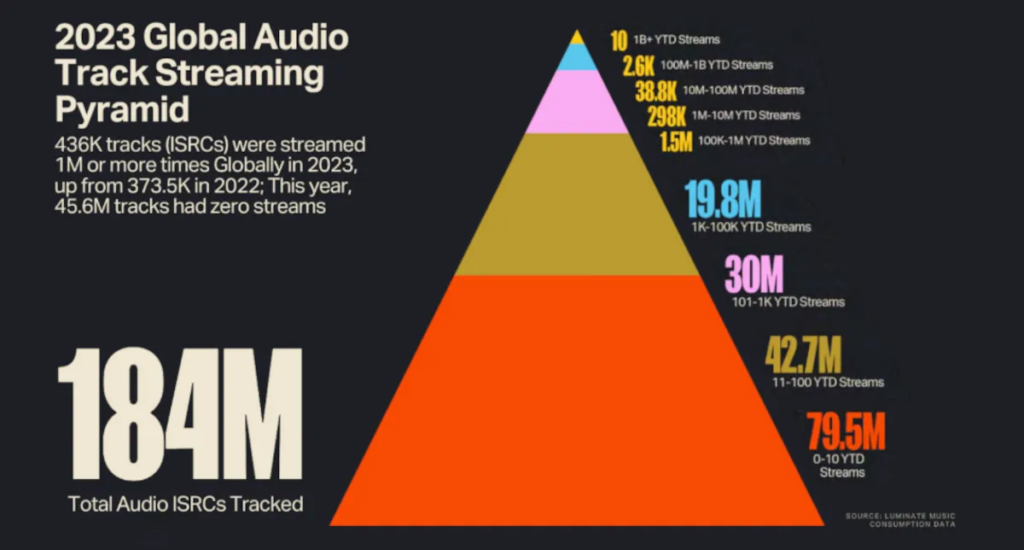

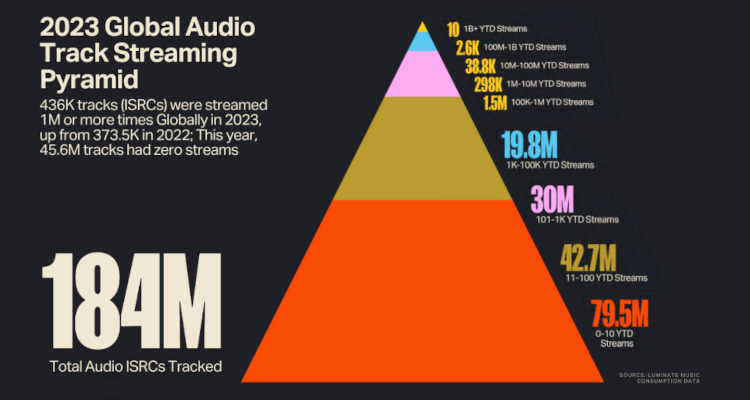

Data suggests that north of 150 million tracks could cease earning recording royalties under the new Spotify royalty model. Photo Credit: Luminate

How many tracks will cease generating recording royalties under Spotify’s new 1,000-stream minimum? North of 150 million, according to consumption data featured in a new report.

Spotify formally unveiled its retooled royalty model (and plans for an early 2024 implementation) in November, setting in motion far-reaching revenue consequences for labels, distributors, and artists alike. The most noteworthy component of the revamped system, the aforementioned play minimum, will in practice block recording (but not publishing-side) payments for any track with less than 1,000 annual streams.

While it has long been common knowledge that the pivot will effectively axe the on-platform recording revenue of many works, we now have a number – or at least an estimate – regarding the extent of the impact.

Yesterday, Luminate in its annual report indicated that about 152.2 million ISRC-equipped audio uploads (presumably referring to human-created songs in the main, with the potential inclusion of some other audio) had generated less than 1,000 streams apiece during 2023.

Behind the figure, the resource shows that 79.5 million tracks each scored between zero and 10 streams on the year, 42.7 million tracks racked up between 11 and 100 streams, and 30 million tracks garnered 101 to 1,000 streams.

Though telling, these sub-1,000 stream counts coincide with recordings monitored not solely on Spotify, but across all major services – meaning that even more works may have failed to hit the mark on the leading music platform in particular.

Focusing specifically on Spotify, however, the 152.2 million tracks with fewer than 1,000 streams to their credit during 2023 represent 82.7 percent of all the audio works tracked by Luminate.

Needless to say, that means the top fifth of tracks on Spotify (and possibly different platforms) will benefit substantially from the recording royalties that would have made their way to other works.

And as we’ve explored, data shows that the Big Three are well-positioned to benefit from this essential redistribution of royalties from lesser known efforts to the world’s most commercially prominent releases.

In the long term, it remains to be seen precisely how the points will affect the way emerging talent opts to make music available – and whether certain prospective artists, who will earn a grand total of $0 in Spotify recording royalties at the outset, will choose to enter the industry in the first place.

Worth highlighting in conclusion is that the same breakdown shows a significant 45.6 million tracks didn’t have any streams at all during 2023.

Link to the source article – https://www.digitalmusicnews.com/2024/01/11/spotify-stream-minimum-impact/

Recommended for you

-

M-Audio M-Track Solo â USB Audio Interface for Recording, Streaming and Podcasting with XLR, Line and DI Inputs, Plus a Software Suite Included

$49,00 Buy From Amazon -

KIDWILL Wireless Bluetooth Karaoke Microphone for Kids, 5-in-1 Portable Handheld Karaoke Mic Speaker Player Recorder with Adjustable Remix FM Radio for Kids Girls Boys Teens Birthday (858-Blue)

$30,99 Buy From Amazon -

Solid State Logic SSL2 2-In/2-Out USB-C Audio Interface

$179,99 Buy From Amazon -

ADAM Audio T7V Studio Monitor for recording, mixing and mastering, Studio Quality Sound (Single)

$249,99 Buy From Amazon -

Laminated Guitar Americana Style Fretboard Notes & Easy Beginner Chord Chart Instructional Poster A New Song Music 11×17

$15,99 Buy From Amazon -

Kids Drum Set, 14 Inch Beginner Drum Kits, 3 Piece Drum Set for Kids Boys Girls, with Adjustable Throne, Cymbal Pedal, Drumsticks, Blue

$108,99 Buy From Amazon -

Alytimes Mirror Disco Ball – 8-Inch Cool and Fun Silver Hanging Party Disco Ball âBig Party Decorations, Party Design

$21,99 Buy From Amazon -

HUAWIND Ukulele, 21 inch Soprano Ukulele For Beginners, Hawaii Toddler Ukelele Four String Wood Uke for Starter (Violet)

$39,99 Buy From Amazon

Responses