SiriusXM Lost 445,000 Self-Pay Subscribers Throughout 2023

Photo Credit: SiriusXM

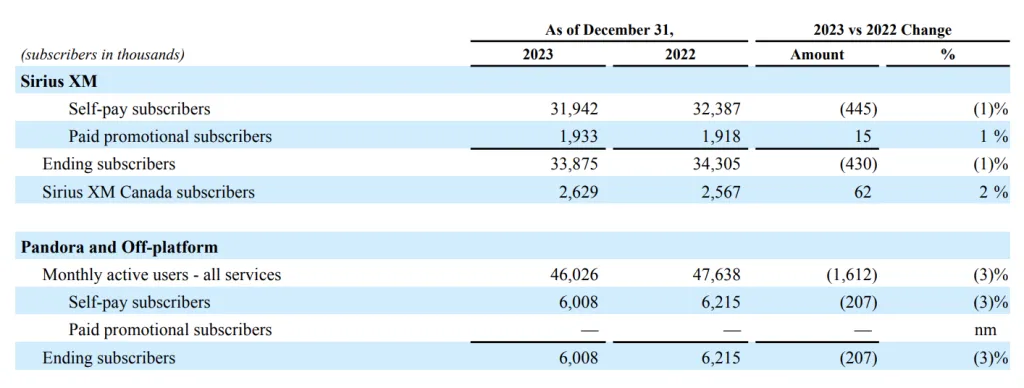

SiriusXM revealed its Q4 2023 financial results, revealing the service lost 445,000 self-pay subscribers throughout the year. Here’s the latest.

The radio giant added 131,000 self-pay subscribers for its satellite radio offering in Q4, following drops across the first three quarters—losses of 96,000 (Q3), 132,000 (Q2), and 347,000 (Q1). SiriusXM lost 430,000 customers driven by that drop of 445,000 self-pay subscribers, while growing its paid promo users by 15,000 in Q4.

The SiriusXM self-pay subscriber base now appears to number around 31.9 million, with total users around 33.9 million. The company predicted a user drop for the full 2023 year due to challenges it is facing with a tight economy and the changing habits of commuters and the car industry.

The Pandora segment saw a drop of 109,000 subscribers in Q4, compared to a loss of 52,000 in Q4 2022. Over 2023, Pandora lost 207,000 subscribers, ending 2023 with around 6 million self-pay streaming customers. Pandora’s quarterly advertising revenue reached $479 million this quarter, down from $480 million a year ago.

Total revenue for Q4 reached $2.29 billion, while SiriusXM revenue for 2023 reached $8.95 billion. The company reported a net income of $352 million for Q4, down 4% from $365 million in 2022, but net income for the full year was up 4% ($1.26 billion) compared to $1.21 billion in 2022. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) fell 4% to $715 million in Q4 and down 2% for the full year to $2.79 billion.

Looking ahead to 2024, SiriusXM predicts revenue of $8.75 billion, down from 2023 and adjusted EBITDA of $2.70 billion. “In 2023, SiriusXM laid the groundwork for future growth through the successful launch of our next-generation platform and the new SiriusXM app,” says SiriusXM CEO Jennifer Witz.

“Our commitment to growth was also demonstrated by strategic content investments that expanded our reach to new listeners and by staying true to our identity as a hub for curated, live, and on-demand audio experiences. As we look to 2024, our guidance reflects substantial efforts and investments to enhance the value proposition of our subscription and advertising businesses, which we believe will strengthen our long-term growth profile.”

Link to the source article – https://www.digitalmusicnews.com/2024/02/01/sirius-xm-lost-self-pay-subscribers-2023/

Recommended for you

-

Blisstime 6 String Acoustic Guitar Bone Bridge Saddle and Nut Made of Real Bone for Acoustic Folk Guitar

$4,99 Buy From Amazon -

CELEBRE METHODE COMPLETE DE TROMPETTE CORNET A PISTONS ET SAXHORN VOL 3 ARBAN

$17,99 Buy From Amazon -

Banjo Chord Chart Cheatsheet for Beginner Adult or Kid, 8” x 11” Banjo Chords Card with Easy Chords, Circle of Fifths, Fretboard Note Reference Guide, Great Learning Aid for Acoustic Electric Banjo

$11,95 Buy From Amazon -

AKAI Professional MPD218 – USB MIDI Controller with 16 MPC Drum Pads, 6 Assignable Knobs, Note Repeat & Full Level Buttons and Production Software

$119,00 Buy From Amazon -

E-mu Orbit 3 – THE King of Dance Modules – Large Original 24bit Multi-Layer WAVe/Kontakt Samples/Loops Studio Library

$14,99 Buy From Amazon -

Moukey 41″ Acoustic Guitar for Beginner Adult Teen Full Size Guitarra Acustica with Chord Poster, Gig Bag, Tuner, Picks, Strings, Capo, Strap Right Hand – Black

$124,99 Buy From Amazon -

Yasisid Closed Hole C Flute 16 Keys Instrument for Student Beginners with Cleaning Kit, Stand, Carrying Case, Gloves and Tuning Rod

$69,99 Buy From Amazon -

Kcelarec Electric Bass Guitar Full Size 4 String Exquisite Stylish Bass with Power Line and Wrench Tool (Yellow)

$44,99 Buy From Amazon

Responses